The software helps each single-company and multi-company payroll administration, making it highly scalable for bureaus and rising companies. Integrations embody in style accounting software program similar to QuickBooks On-line, Xero, NetSuite, and Sage Intacct, in addition to time-tracking add-ons and international contractor/EOR providers to extend capabilities. Specifically is a comprehensive HR and payroll software specifically designed for mid-sized firms.

Features embody Workforce OS, payroll and funds, worker portal, JE reconciliation, country specialists, workforce analytics, compliance, data security, Papaya 360 support, and embedded AI. They additionally provide global workforce payments which are on-time, regulated, and automated. Justworks Payroll stands out as a outcome of it bundles full payroll processing with entry to competitive employee advantages and sturdy HR tools—all in a single platform.

Get Product Help

The excellent news is Enhanced Payroll helps take the sting out of tax season by making certain you are compliant all yr round. From calculating payroll taxes to filing them, the software covers all bases. It’ll ask for your small business data, like EIN and tax details, so maintain these handy. Whether you might have a roster of three or thirty, inputting their particulars is straightforward.

The payroll apps we decide are broadly available and comparatively easy to train on, with sturdy options and reasonable pricing. We additionally look carefully at options such as worker and client portals, consumer onboarding companies, PTO administration, advantages administration, multistate compliance, and more. The methods should additionally connect securely and reliably with firm and employee bank accounts. Square Payroll is noted for being affordable and straightforward to make use of, especially for eating places, retailers and other service companies that wish to combine payroll processing with their POS system. The software program mechanically calculates and pays payroll taxes and helps paying W-2 employees and contractors. Its modular pricing, automated compliance tools, and accountant-focused features place it at the forefront of payroll solutions tailored for the monetary providers sector.

Resolving Camps Sign-in Issues In Quickbooks – Intuit Person Guide

Justworks complements its single payroll and HR plan with two skilled employer group (PEO) merchandise. PEO Fundamental costs $59 a month per individual and includes multi-state payroll, contractor funds and off-cycle payroll runs. The high-end PEO Plus is priced at $109 a month per individual https://www.quickbooks-payroll.org/ and adds vendor funds and superior analytics.

Companies that depend on QuickBooks for his or her accounting wants often look for ways to streamline payroll administration. “Enhanced Payroll for Accountants” stands out as a useful answer. It seamlessly integrates with QuickBooks, providing a sturdy suite of features tailored for both accountants and their small business clients. By diving deep into its functionalities, accountants can enhance efficiency, accuracy, and client satisfaction. Gusto users can get a same-day direct deposit only if they join Gusto Wallet.

Compare The Best Payroll Software For Accountants Of 2025

We perceive the importance of a reliable monthly invoice for you and your purchasers, which is why we are providing the continuing month-to-month discount to accounting professionals through the ProAdvisor discount. When you choose this feature, Intuit will invoice your firm every month for all eligible client subscriptions and you can benefit from the ongoing savings month after month. The ProAdvisor Preferred Pricing program is out there for new QuickBooks Online, QuickBooks Online Payroll and QuickBooks Time subscriptions only. If a QuickBooks Online Accountant account assumes the billing for an current subscription, they are charged the then-current list price with out extra discounts.

It routinely imports needed knowledge and prepares 1099s that you simply simply must download and e mail to the contractors. You can reap the benefits of QuickBooks presents, the place you presumably can both get a 30-day free trial or a 50% low cost on base charges for three months of service. QuickBooks Payroll lets you provide aggressive advantages to your employees. It offers workers’ compensation by way of AP Intego and health benefits, inexpensive medical, dental and vision insurance packages by SimplyInsured. Software Experts’ editorial staff famous that QuickBooks Payroll’s integration with QuickBooks Online is among the platform’s defining strengths.

Add the perfect payroll solution to your clients’ QuickBooks subscription and energy via payroll with super-charged software program. Our intuitive payroll software program for accountants makes it straightforward for you to be your clients’ payroll supervisor. Payroll software can prevent time and money by automating tax submitting, direct deposit and employee accounting software with payroll self-service. It also can allow you to handle your payroll, HR, benefits and expertise from a single platform. Accounting professionals right now face complex challenges, including remote workforce administration, multi-state payroll processing, and evolving shopper needs. Platforms like QuickBooks Payroll that integrate immediately with core accounting techniques are gaining traction as companies prioritize effectivity and accuracy over guide systems.

- One distinguishing function is Rippling’s customized workflow automations, together with Recipes, or workflow templates, for retroactive payroll adjustments, referral bonuses and other common duties.

- It automatically imports essential information and prepares 1099s that you just just need to obtain and email to the contractors.

- Selecting payroll software program for accountants entails consideration of your business’s specific needs and finances constraints.

- The right balance between price and functionality will guarantee you could present efficient and compliant payroll companies to your purchasers.

- QuickBooks has an easy-to-use dashboard from the place you’ll be able to handle the payroll of your staff as well as impartial contractors.

- Start by navigating to the “Employees” menu in QuickBooks, where you may discover the “Payroll Setup” possibility.

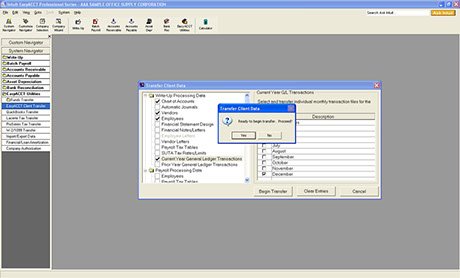

The QuickBooks enhanced payroll for accountants offers an option to import and export knowledge in several formats such as Excel or CSV. By the usage of the mapping choice, a consumer can simply import knowledge from totally different methods. Spend extra time advising shoppers and less time on payroll and workforce providers with QuickBooks Online Payroll. Whether Or Not you’re a big accounting firm or an accounting team of 1, QuickBooks Online Payroll has instruments that can help you develop. Rippling is finest suited to bigger corporations that serve clients with advanced payroll, HR, and IT wants.